401k cash out penalty calculator

2000 would go to the 10 penalty. Rolling Over Funds in a Roth 401k.

3 Times It S Ok To Dip Into Your 401 K 13newsnow Com

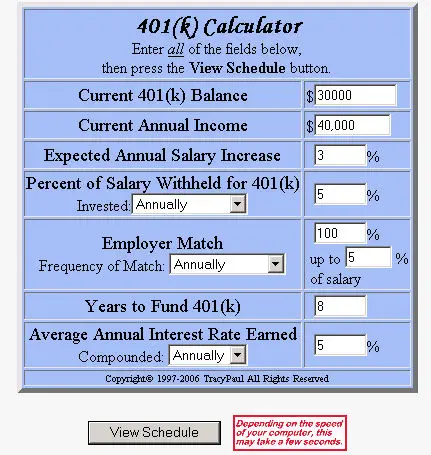

Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b.

. You may also have to pay an additional 10 tax. How to Cash Out Your 401k. As long as you dont qualify.

3600 would go to taxes 20 of 18000. While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses know that you could lose a significant portion of that money right from the start. A good rule of thumb is to expect to lose about half of your money to taxes and penalties at the federal and state levels.

Federal Tax Penalty Early withdrawals from a tax-deferred. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset growth tax consequences and penalties based on information you specify. Section 2022 of the CARES Act allows people to take up to 100000 out of a retirement plan without incurring the 10 penalty.

So if you take 20000 out of your 401 k before you reach 59 12 youll have 4000 in taxes withheld and keep 16000. With a click of a button you can easily spot the difference presented in two scenarios. You must pay income tax on any previously untaxed money you receive as a hardship distribution.

Penalties for those under age 59½ who withdraw money from traditional or Roth IRAs or 401ks went back into effect starting Jan. This cash out calculator can be used to estimate the gain or loss when cashing out a retirement plan such as a 401k or 403b account. This is not a.

Additionally some 401k plans allow you to borrow from the plan usually up to 50 of the vested account balance with a maximum of 50000 that must be repaid within five years. The calculator inputs consist of the retirement account balance age of participant income tax brackets and the projected return on investment. For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take home 14400.

Call us at 1-888-695-4472. Ad If you have a 500000 portfolio download your free copy of this guide now. This is a hypothetical illustration used for informational purposes only and reflects 10 federal income tax rate and 0 state income tax rate plus a 10 IRS early withdrawal penalty on the cash distribution amount and information as entered by you.

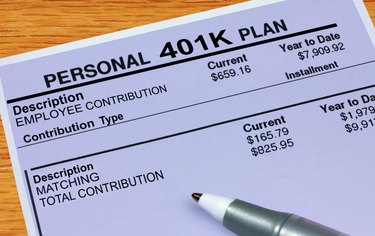

Most times when you cash out only 10 of the money is withheld and sent. This includes both workplace plans like a 401k or 403b and individual plans like an IRA. Also you can roll over funds from your 401k plan into another retirement plan.

Calculating your penalty for cashing out If all of your contributions were made on a pre-tax basis such as with a 401 k or traditional IRA the calculation is easy. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. One less-noticed part of the bill though changes the way that pre-retirement withdrawals from retirement plans work.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate and your expected annual rate of return. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. If you start taking money out of your 401 k early youll pay taxes of 20 percent of what you withdraw.

The amount of the hardship distribution will permanently reduce the amount youll have in the plan at retirement. As mentioned above this is in addition to the 10 penalty. Using this 401k early withdrawal calculator is easy.

Income taxes a 10 federal penalty tax for early distribution and state taxes could leave you with barely over half of your original. NerdWallets 401 k retirement calculator estimates what your 401 k balance will be at. The example assumes 6 average annual return on the rollover and the.

However you should know these consequences before taking a hardship distribution.

Free 401k Retirement Calculators Research401k

401 K Calculator Credit Karma

Beware Of Cashing Out A 401 K Pension Parameters

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

401k Calculator

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Retirement Accounts A Comprehensive Guide Meld Financial

Cashing Out Your 401 K What You Need To Know

401 K Withdrawal Calculator Nerdwallet

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Should You Withdraw Funds From Your 401k The Ifw

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

How To Roll Over Your 401 K To An Ira Smartasset

Pin On Buying Selling A Home

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020